Novavax is a biotechnology company that focuses on the discovery, development, and commercialization of vaccines to prevent serious infectious diseases. Keep reading to find reasons why Novavax shares can soar again.

During the COVID-19 pandemic, Novavax created an alternative vaccine to that of companies such as Pfizer (NYSE: PFE) and Johnson and Johnson (NYSE: JNJ). In 2020, the U.S government bought 100 million doses of the Novavax vaccine. This gave them $1.6 Billion to ramp up their research and production of their vaccine NVX-coV2372.

According to the Food and Health Administration (FDA), their vaccine now carries a 90.4% efficiency rate in participants over 18 years old and could soon be approved for use in the U.S.

After a delay in the FDA authorization earlier this month, investors of NVAX were left disappointed. Shares traded down more than 17% after the news broke. However, this does not mean it won’t be authorized, in fact, it could be authorized very soon.

During the height of the pandemic, shares of NVAX soared from $4 to around $300. Now trading at around $50, investors still feel like NVAX can reach their highs again.

Here are some reasons why Novavax shares can soar again:

New vaccine contracts will bring in HUGE amounts of revenue

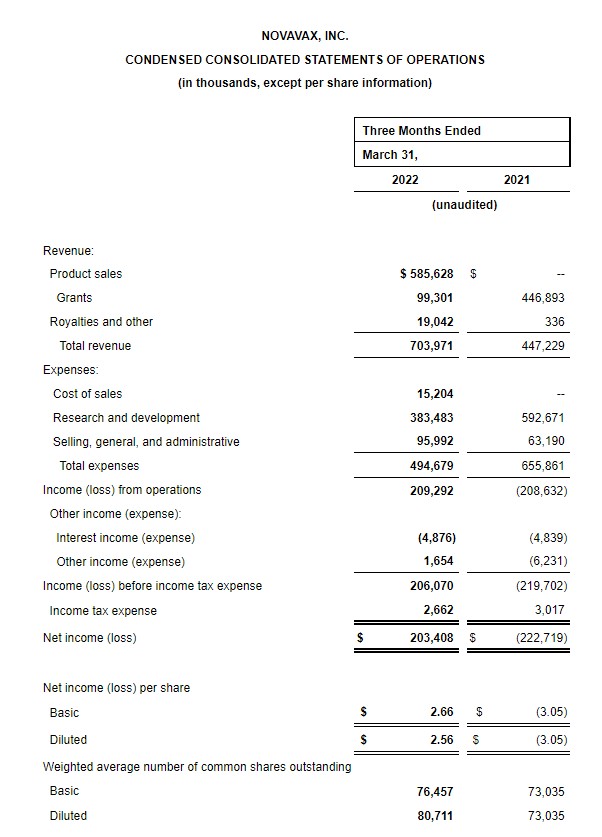

In the first earnings report of the year, NVAX reported its first-ever profitable quarter. They achieved $704 Million in revenue and a profit of $203 Million. Mainly down to the worldwide launch of their COVID-19 vaccine. This is a huge improvement when compared to the net loss of $223 Million last year. Of the revenue, $586 million was from product sales of the COVID-19 vaccine alone. Novavax also receives lots of money from funding and grants to continue its research and development of products.

So far, Novavax has received 2 billion orders for their protein-based COVID-19 vaccine. And the 2022 full-year revenue is expected to be between $4 and $5 billion. This is a huge revenue boost from $1.1 billion reported in 2021.

If they are able to meet these expectations, this could be a great opportunity to buy NVAX.

Development of new products

With new COVID-19 variants emerging, Novavax is developing vaccines that go beyond COVID-19. One product that could be game-changing is Novavaxs’ CIC vaccine.

The CIC vaccine is a COVID-19-Influenza vaccine that combines the NVX-coV2372 and quadrivalent influenza vaccine together.

The CIC phase 2 trial is expected by the end of 2022, with the results of the phase 1 trial showing that the vaccine shows potential for immune response and an ability to reduce total antigens by 50%.

This is huge news for investors of Novavax as there is currently no other product on the market that combines the COVID/flu vaccines into one shot. If these trials work well, this can be a game-changer in the market and could cause shares in NVAX to skyrocket.

Future contracts and agreements

At the time of writing, the share price of NVAX is $50. This is incredibly cheap considering the growth potential and the possibilities of NVAX. With U.S approval around the corner, this will add to the already huge rollout that Novavax has delivered.

42 million doses of the vaccine have been delivered to countries around the world such as Canada, South Korea, Australia, Taiwan etc.

Novavax also has advanced-purchase agreements for up to 430 million doses. If these can be delivered, the revenue that NVAX will bring in over the coming years will be more than they have ever seen.

Conclusion

With COVID-19 changing and mutating, companies are working to find solutions that will stop its indefinity. Novavax seems to have already progressed their business in a way that is ready to deal with the new strains that come our way and are looking ahead.

Whilst they may not be able to ever compete on the same scale as Pfizer and its competitors, they could soon be a leader during the next stage of the pandemic. Their COVID-19-influenza combo shot could make them market leaders in the next stage and lead to higher growth in the future.

Share your opinions and your price predictions here:

TrendyToros has no position in any of the companies mentioned. Views expressed on the companies and assets mentioned in this article are those of the writer and not TrendyToros Ltd.