DeFi, or decentralized finance, refers to a new financial system that is built on blockchain technology and operates without traditional intermediaries, such as banks or financial institutions.

DeFi has gained significant popularity in recent years due to its ability to provide financial services that are more accessible, transparent, and secure compared to traditional finance.

DeFi platforms allow users to access a wide range of financial services, such as lending and borrowing, trading, payments, and insurance, through decentralized applications (dApps). These dApps are powered by smart contracts, which are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code.

One of the main benefits of DeFi is its accessibility. DeFi platforms are open to anyone with an internet connection, regardless of their location or financial status. This enables people in countries with underdeveloped financial systems or those who are unbanked or underbanked to access financial services that were previously unavailable to them.

DeFi also offers increased transparency compared to traditional finance. Transactions on a blockchain are visible to all participants, making it easy to track the movement of assets and ensure that all parties are following the terms of the contract. This transparency can help reduce the risk of fraud and corruption.

In addition to its accessibility and transparency, DeFi is also more secure compared to traditional finance. Blockchain technology is inherently secure due to its decentralized nature, which makes it resistant to tampering and censorship. This can help reduce the risk of hacks and other security breaches, which are a common concern in traditional financial systems.

Overall, DeFi has the potential to revolutionize the financial industry and make financial services more accessible, transparent, and secure for everyone.

The Benefits of DeFi:

DeFi has several benefits compared to traditional finance, including increased accessibility, transparency, and security.

One of the main benefits of DeFi is its accessibility. DeFi platforms are open to anyone with an internet connection, regardless of their location or financial status. This enables people in countries with underdeveloped financial systems or those who are unbanked or underbanked to access financial services that were previously unavailable to them. DeFi also enables users to access financial services without the need for a traditional bank account, which can be difficult or expensive to obtain in some cases.

In addition to its accessibility, DeFi also offers increased transparency compared to traditional finance. Transactions on a blockchain are visible to all participants, making it easy to track the movement of assets and ensure that all parties are following the terms of the contract. This transparency can help reduce the risk of fraud and corruption, as well as increase trust and confidence in the financial system.

DeFi is also more secure compared to traditional finance. Blockchain technology is inherently secure due to its decentralized nature, which makes it resistant to tampering and censorship. This can help reduce the risk of hacks and other security breaches, which are a common concern in traditional financial systems. DeFi also offers users more control over their assets, as they can hold and manage them directly on the blockchain rather than relying on a third party to do so.

Overall, DeFi offers a number of benefits compared to traditional finance, including increased accessibility, transparency, and security. These benefits have contributed to the growing popularity of DeFi in recent years.

How it works:

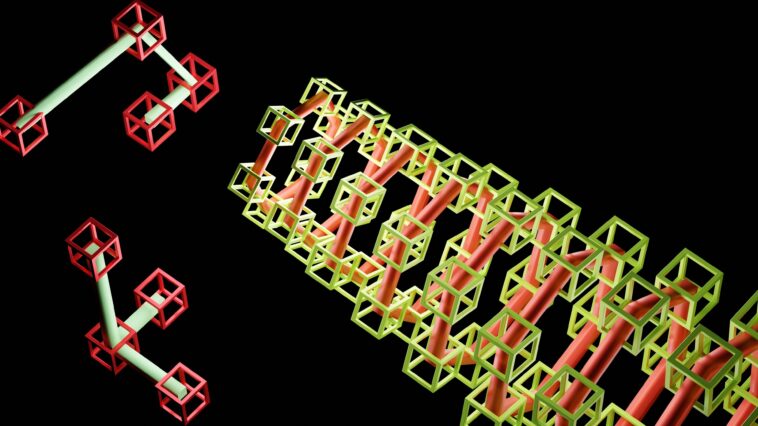

DeFi platforms operate by using smart contracts and blockchain technology to enable decentralized financial transactions.

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. They are stored and replicated on a blockchain, which is a decentralized database that records transactions in a secure and transparent manner.

When a user wants to access a financial service on a DeFi platform, they interact with a decentralized application (dApp) through their web browser or a mobile app. The dApp connects to the blockchain and executes the smart contract, facilitating the financial transaction.

For example, if a user wants to borrow money on a DeFi lending platform, they can initiate a smart contract that specifies the terms of the loan, such as the amount borrowed, the interest rate, and the repayment period. The smart contract will then be automatically executed on the blockchain, releasing the funds to the borrower and creating a record of the loan. The borrower can then use the funds as they wish, and the smart contract will automatically enforce the repayment terms.

In this way, DeFi platforms allow users to access financial services directly, without the need for traditional intermediaries such as banks. This can make the process faster, cheaper, and more efficient compared to traditional finance.

Overall, DeFi platforms use smart contracts and blockchain technology to facilitate decentralized financial transactions and provide a wide range of financial services to users.

Popular applications:

DeFi platforms offer a wide range of financial services, including lending and borrowing, trading, payments, and insurance. Some of the most popular DeFi applications include:

- Lending and borrowing platforms: These platforms allow users to lend or borrow funds from each other without the need for a traditional bank. Borrowers can access funds at competitive rates, while lenders can earn a return on their investment. These platforms often use smart contracts to automate the process and ensure that all parties follow the terms of the loan.

- Decentralized exchanges (DEXs): DEXs are online platforms that allow users to buy and sell cryptocurrencies directly with each other, without the need for a centralized exchange. DEXs use smart contracts to facilitate the exchange of assets and ensure that all parties follow the terms of the trade. DEXs can offer users greater control over their assets and lower fees compared to centralized exchanges.

- Stablecoins: Stablecoins are cryptocurrencies pegged to a stable asset, such as the US dollar or gold. They are designed to maintain a stable value and minimize price volatility. Stablecoins can be used for various financial applications, such as enabling cross-border payments, facilitating trade, and providing a store of value. DeFi platforms often use stablecoins as a means of exchange or a way to hold assets. For example Tether Gold (XAUT)

Overall, DeFi platforms offer a wide range of financial services, including lending and borrowing, decentralized exchanges, and stablecoins. These applications have contributed to the growing popularity of DeFi in recent years.

Risks and challenges:

While DeFi has the potential to revolutionize the financial industry, it also has some risks and challenges that users should be aware of.

One risk is liquidity issues. Some DeFi platforms may have low liquidity, which can make it difficult for users to buy or sell assets quickly. This can lead to price slippage, where the price of the asset changes significantly between the time the order is placed and the time it is filled. Liquidity issues can also make it harder for users to exit a position or get their funds back if they need to.

Another risk is the potential for hacks or other security breaches. DeFi platforms operate on the blockchain, which is inherently secure due to its decentralized nature. However, hackers can still find ways to exploit vulnerabilities in the system or steal users’ assets. It is important for users to be aware of these risks and take steps to protect their assets, such as using strong passwords and enabling two-factor authentication.

In addition to these risks, DeFi also faces regulatory challenges. Many DeFi platforms operate in a legal grey area, and it is unclear how they will be regulated in the future. This can create uncertainty for users and may impact the viability of DeFi platforms.

Overall, DeFi has some risks and challenges that users should be aware of, including liquidity issues, security breaches, and regulatory uncertainty. It is important for users to carefully consider these risks before using DeFi platforms and to take steps to protect their assets

Conclusion

DeFi platforms offer a wide range of financial services, including lending and borrowing, decentralized exchanges, and stablecoins. The technology has the potential to revolutionize the financial industry by making financial services more accessible, transparent, and secure.

However, DeFi also has some risks and challenges that users should be aware of, including liquidity issues, security breaches, and regulatory uncertainty. It is important for users to carefully consider these risks before using DeFi platforms and to take steps to protect their assets.

Looking to the future, it is likely that DeFi will continue to grow and evolve as more people become aware of its benefits and as the technology improves. DeFi has the potential to democratize finance and bring financial services to people who were previously excluded from the traditional financial system. It will be interesting to see how DeFi develops and how it will impact the financial industry in the years to come.

This post was generated with the help of AI technology. Find out more here.