Stock market bubbles have occurred throughout history and can have serious economic consequences. Understanding the characteristics and causes of stock market bubbles is crucial for investors and policymakers alike.

In this blog post, we will explore the concept of stock market bubbles and highlight some of the most notorious examples in history. By analyzing the Dutch Tulip Mania of the 17th century, the South Sea Bubble of the 18th century, the Dot-Com Bubble of the late 1990s/early 2000s, and the Housing Bubble of the 2000s, we will draw parallels and identify common themes that can help investors and policymakers recognize and prevent bubbles from forming in the future.

Let’s dive in and explore the fascinating world of stock market bubbles.

What is a Stock Market Bubble?

A stock market bubble is a situation in which stock prices are driven far above their fundamental values by speculation, hype, and irrational exuberance. Bubbles occur when investors, buoyed by a sense of optimism and a fear of missing out, pour money into a particular sector or asset class, driving up prices to unsustainable levels.

During a bubble, investors may ignore traditional metrics such as price-to-earnings ratios and instead focus on speculative factors such as market sentiment and news events. This can lead to a feedback loop in which rising prices fuel even more buying, creating a self-fulfilling prophecy.

However, bubbles inevitably burst when reality sets in and investors realize that prices have become detached from underlying economic fundamentals. This can lead to a sudden and sharp decline in prices, wiping out the savings of many investors and causing widespread economic damage.

Some common characteristics of stock market bubbles include rapidly rising prices, excessive trading volumes, and a high level of speculation. Bubbles can occur in any asset class, from stocks and real estate to cryptocurrencies and commodities.

In the next sections of this blog post, we will examine some of the most famous stock market bubbles in history, including the Dutch Tulip Mania, the South Sea Bubble, the Dot-Com Bubble, and the Housing Bubble of the 2000s. By understanding these bubbles and the factors that contributed to their formation, we can gain valuable insights into the nature of financial markets and how to avoid the pitfalls of irrational exuberance.

Historical Stock Market Bubbles:

The Dutch Tulip Mania of the 17th Century

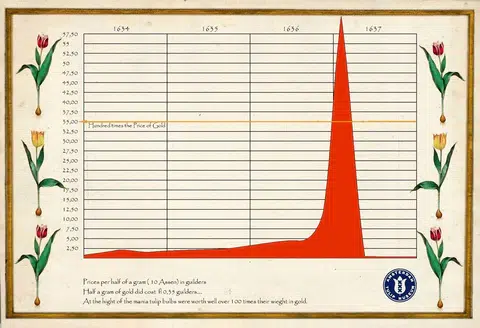

The Dutch Tulip Mania is perhaps the most famous example of a stock market bubble in history.

During the early 17th century, when tulips were highly prized and considered a symbol of wealth and prosperity, a speculative frenzy occurred in the Netherlands, leading to a notorious event known as the Tulip Mania.

The mania began in the mid-1630s, when speculators began buying up tulip bulbs at increasingly high prices, hoping to sell them for even higher prices in the future. The market for tulips became increasingly frenzied, with some bulbs selling for the equivalent of thousands of dollars in today’s currency.

However, the bubble burst in early 1637, when prices for tulip bulbs suddenly plummeted, leaving many investors with worthless bulbs and huge financial losses. The Dutch Tulip Mania had a profound impact on the Dutch economy and serves as a cautionary tale about the dangers of unchecked speculation in financial markets.

The South Sea Bubble of the 18th Century

The South Sea Bubble was a financial crisis that occurred in England in the early 18th century. It was named after the South Sea Company, which was established in 1711 to manage England’s national debt.

The company was granted a monopoly on trade with Spanish South America, and its shares were highly sought after by investors. The company’s directors took advantage of the hype surrounding the company’s prospects and inflated the share price, leading to a speculative bubble.

In 1720, the bubble burst when the company’s true financial situation was revealed, causing the stock price to plummet and wiping out many investors’ savings. The crisis had significant economic and political consequences, including a loss of confidence in the financial system and a rise in public anger and discontent.

The South Sea Bubble serves as a warning about the dangers of unchecked greed and highlights the importance of transparency and regulation in financial markets.

The Dot-Com Bubble of the Late 1990s/Early 2000s

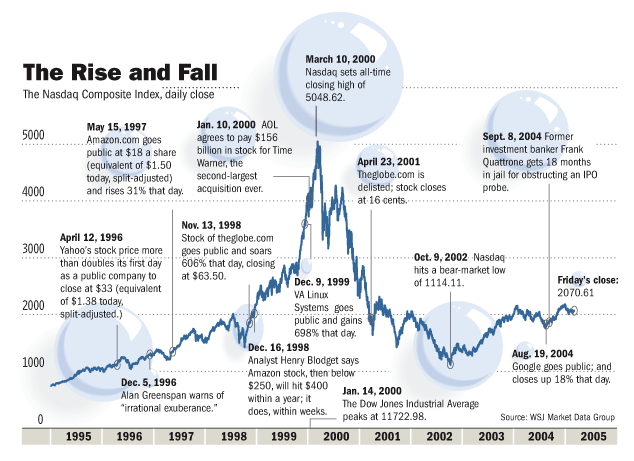

The Dot-Com Bubble was a stock market bubble that occurred in the late 1990s and early 2000s, fueled by the rise of the internet and new technology companies. The bubble was characterized by inflated stock prices and rampant speculation, particularly in the technology sector.

Investors were eager to buy shares of internet companies, many of which had yet to turn a profit, in the hopes of making quick returns. In 2000, a bubble burst as investors valued companies with no clear path to profitability at astronomical prices, which ultimately led to a significant downturn in the stock market

The collapse of the Dot-Com Bubble had far-reaching consequences, including the failure of many internet companies, job losses, and a significant decline in stock prices. The bubble serves as a reminder of the importance of fundamental analysis and due diligence when investing, and the dangers of relying solely on hype and speculation.

In the next section, we will explore the Housing Bubble of the 2000s, which had a significant impact on the global economy.

The Housing Bubble of the 2000s

The Housing Bubble of the 2000s was a significant stock market bubble that occurred in the United States and had a ripple effect throughout the global economy. Loose lending practices allowed people to take out mortgages they couldn’t afford, contributing to rapidly rising housing prices that characterized the bubble.

Investors poured money into the housing market, betting on the continued appreciation of home values. Banks and other financial institutions also got in on the action, offering high-risk loans to people with poor credit histories.

In 2008, the bubble burst, leading to a global financial crisis. The collapse of the housing market led to widespread foreclosures, job losses, and a sharp decline in stock prices. The crisis had far-reaching consequences, including government bailouts of financial institutions and a loss of confidence in the financial system.

The Housing Bubble of the 2000s serves as a warning about the dangers of unsustainable growth and the importance of responsible lending practices. It also highlights the interconnectedness of the global economy and the need for international cooperation in preventing future crises.

The Future of Stock Market Bubbles

Given the history of stock market bubbles, it’s natural to wonder whether they will continue to occur in the future. While it’s impossible to predict the future with certainty, there are several factors that could contribute to the formation of future bubbles.

One factor is the increasing availability of information and the ease of trading through technology. With the rise of social media and online trading platforms, investors have access to more information than ever before and can execute trades quickly and easily. While this can lead to more efficient markets, it can also lead to herd behaviour and a greater risk of bubbles forming.

Another factor is the increasing popularity of new asset classes such as cryptocurrencies and non-fungible tokens (NFTs). This could create new opportunities for bubbles to form. These assets are often difficult to value and can be subject to extreme price fluctuations, making them ripe for speculation.

Despite these factors, there are also reasons to be optimistic about the future of financial markets. Regulators have taken steps to improve transparency and reduce risk, and investors are becoming increasingly aware of the dangers of bubbles and the importance of long-term investing.

Ultimately, the future of stock market bubbles will depend on a complex interplay of economic, technological, and social factors.

Conclusion

In conclusion, stock market bubbles have occurred throughout history and have had serious economic consequences. By examining the Dutch Tulip Mania, the South Sea Bubble, the Dot-Com Bubble, and the Housing Bubble, we can identify common themes and lessons that can help investors and policymakers recognize and prevent bubbles from forming in the future. By taking a cautious and informed approach to investing, we can work towards a more stable and sustainable financial system.